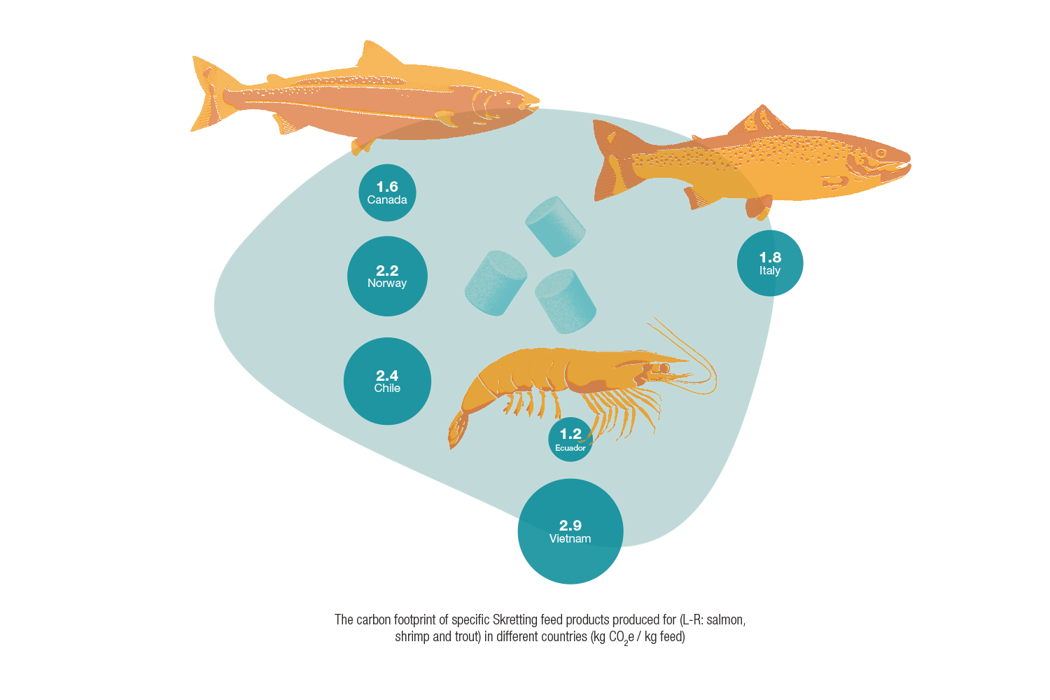

The difference based on species can be due to different nutritional requirements of the species within their specific environments, which has a subsequent influence on the type of ingredients that are required. In addition to nutrition, we have to consider the biophysical characteristics of the feed itself, in order to reduce feed loss and optimise feed uptake, for example.

Moreover, purchasing and regulatory conditions can be quite different in the different regions and countries of the world, which impacts the feed composition, raw material availability and origins, and subsequently the feed footprint.

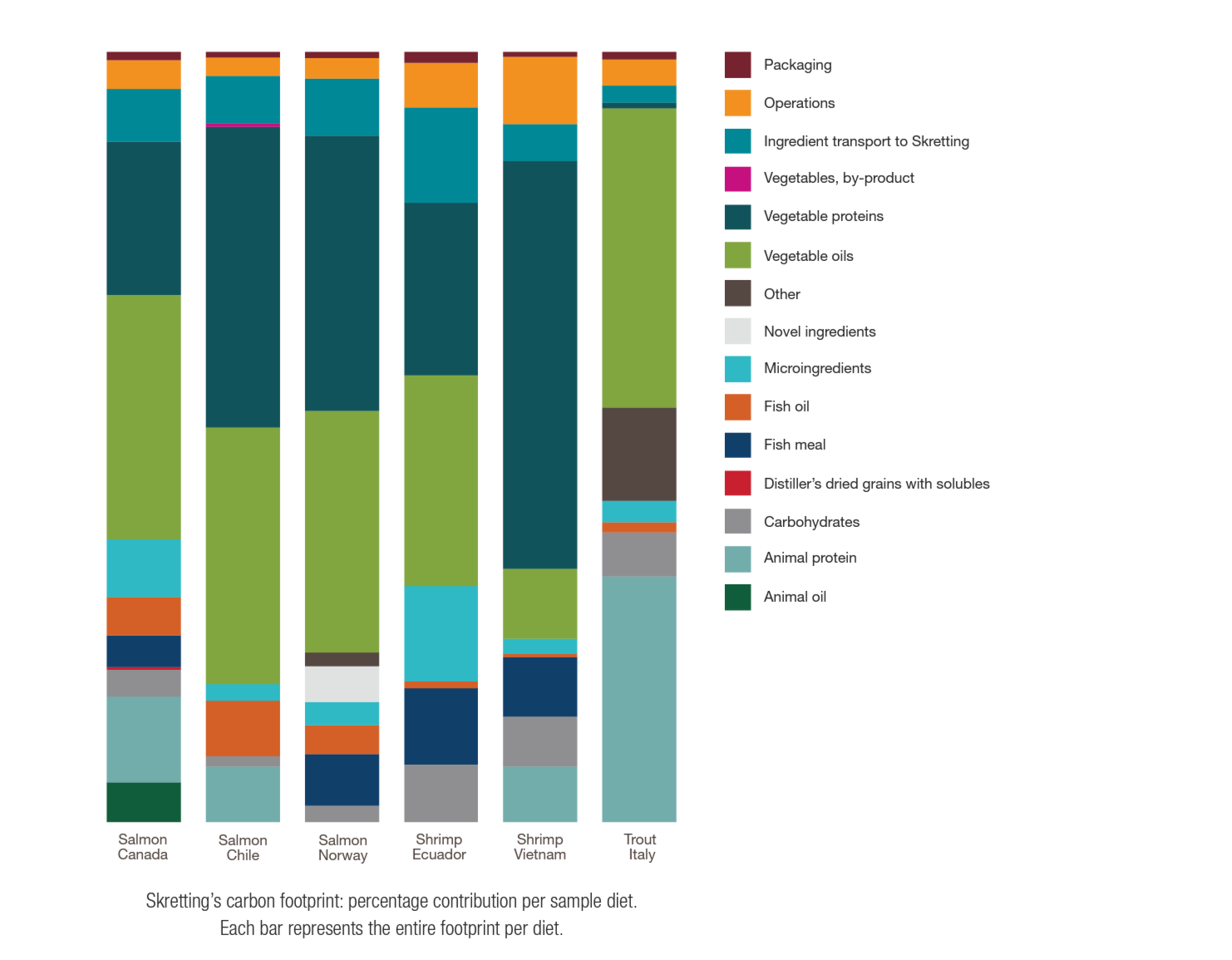

To provide further insights into these differences and the main causes, the carbon footprint for a range of Skretting feeds is shown on this page. Further on, we take a closer look at the drivers of the differences in carbon footprint per region (for example a salmon feed produced in Canada, Chile and Norway) and also a comparison between species (salmon feed, shrimp feed, trout feed).